Budgeting for teens is tough but is a necessary lesson to teach them when you’re a parent. We all want our teenagers to understand the value of a dollar. Here are tips for teaching teens how to budget, and a tool that enables them to be independent along the way.

I will say I am pretty thrifty and have taught my girls to appreciate the value of a dollar, but teaching budgeting for teens is an ongoing process that continues even after they leave home for college. Establishing a strong appreciation for money early on is key to their success later in life, and becoming financially responsible adults. All I can say is…start early! Here are 10 budgeting for teens tips I have tried to ingrain in my daughter, and now that she is making her own money she sure does appreciate it.

Budgeting Apps for Teens

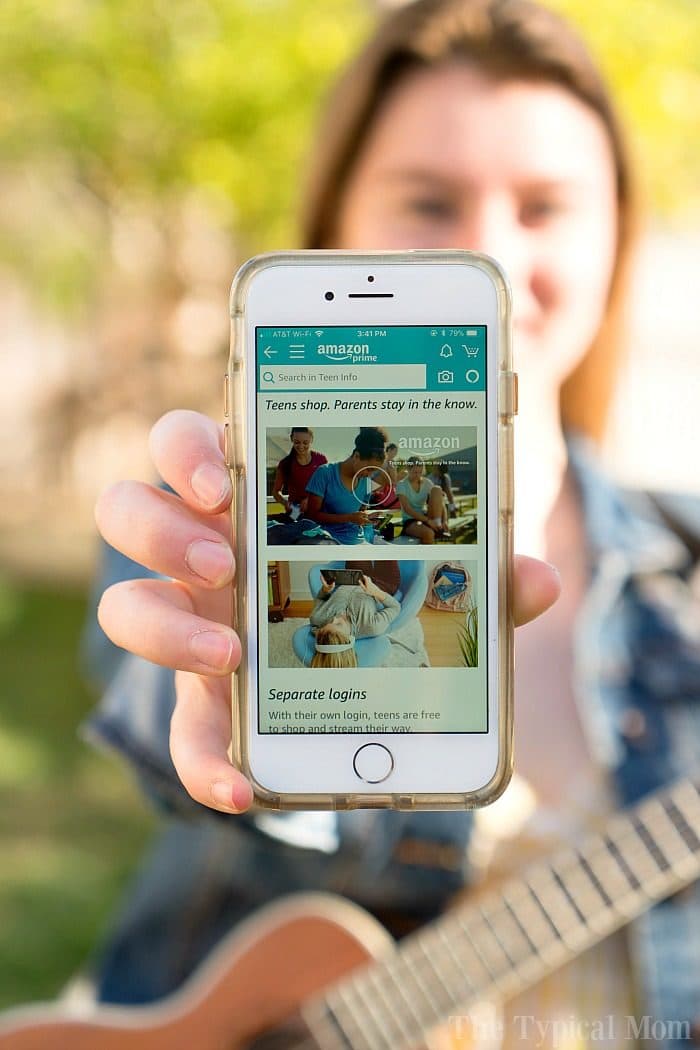

- This is my oldest, she’s 17. I don’t know how exactly I am the mother of an almost adult but I am. She’s incredibly musically talented (not sure where that came from), independent, and driven.

Driven I say in many ways. That has been a great quality in her. At the same time can cause issues as when she wants something she wants it NOW.

Money Management for Teens

She hasn’t always looked at the big picture when it came to how much an item cost, and how much money she’d have left for the rest of the month if she spent it all in one swoop. That’s where this whole parenting thing comes in I guess. 😉

Starting young I would take my girls to the store (I have 3 daughters) with the Christmas money from their great aunt and allow them to spend it on whatever they wished.

I was surprised to see early on they would find what was on sale, decide whether they wanted to pool their money to get something bigger, or spend a little and save the rest for later.

It kinda’ didn’t surprise me because I’m the queen of “let’s find what we need on sale, or at the best price…time to comparison shop!” Clearly they must’ve been listening even though I didn’t think they were when they were little.

Teen Budgeting Tool

Here are my tips:

- How to spend money responsibly – Now that they’re teenagers they need to be given a bit more independence and not feel like we are looking over their shoulder at every turn. Of course giving them free reign is not going to happen, but baby steps are good to get them ready for “the real world” once they leave the nest.

- A good way to start is to add a teen to your Amazon account and allow them to make purchases. The way it works is they create an account that is attached to yours so you have to approve their purchases.

- You designate where it’s being sent as well. I will explain how we did it but you can read how the Amazon teen login works here too.

- Teaching them how to save money at the store is important too.

- Start young – Like my story here….they are listening! Take them to the store with you (take them one on one if you really have a handful) and talk out loud when you’re on a budget at the grocery store and trying to stick to it.

If you’re using coupons have them out and explain what you’re doing. Even small children will get into it if you engage them in the activity. Have them hold it and look for the item together like you’re having a treasure hunt, make it fun!

- Open a bank account with them – When they are around 8 or so (when we did it) take them to the bank to open their own bank account…it’s so exciting for them! Explain that this is the place to put your money in and watch it grow.

- That the longer you leave it there the more you’ll have, and you can save up ALL that money until you get enough to buy something larger.

- Show them how to keep track of their spending – This goes with opening a bank account. Once they’re teenagers it is a good for them to keep track of the money in their account. If they have a debit card linked to their account teach them how to log into their account to see how much they’re spending.

- Talk about the consequences for spending more than they have in their account. The first steps in budgeting for teens.

- First job lessons – If their schedule allows it I highly recommend allowing your teenager to get a job. Even if it is only a few hours a week it gives them a bit of independence, responsibility, and they learn how to put others first (especially if they’re in customer service).

Along with hard work comes money, and they can now watch their bank account grow! The next step is teaching teens how to budget the money coming in, and the necessity of putting aside some of that money for things like gas that is not so much fun but part of making that money.

- Give them ways to earn money – If they aren’t old enough or you aren’t comfortable with them getting a job outside of the house, give your teen opportunities to earn money at home. Choose chores you don’t have the time to do (or are your least favorite) in order to help you out.

- This is a great way to learn that with work comes reward. Believe me, they will appreciate money more after cleaning a few toilets and mowing a few lawns. 😉

- Using credit cards – We’re in the day and age where we buy almost everything online (at least we do in this house). The great part about this is we can comparison shop quickly without driving all around town.

At the same time it is harder to “see” what you’re spending when your teens are used to dealing with cash. Teaching them that whatever you put on a credit card needs to be paid back at the end of every month is a very important lesson to learn early on.

Steps for Signup:

- Invite your teen to create an Amazon teen login for free by entering their name and phone number / or email address

- Link them to your Amazon account

- Choose which credit card of yours you will allow them to use when making purchases (don’t worry…they can’t see your full card information, that is always kept secure)

- Choose the address where all purchases will be shipped to

Enter your cell phone number or email address where their purchases will have to be approved by you via this method (I chose cell phone since I always have that on me).

Yes my daughter is fairly responsible at 17, but there is a lot more to be learned. With this teen program thru Amazon it gives her some freedom to comparison shop on her own time, add items to the cart she would like to get, and I can monitor her purchases on my phone which gives her a bit more space.

Since you’re able to designate a specific credit card to be used for their purchases it is a great way for both of you to track their spending.

- If they’re earning an allowance at home you can keep track of their earnings and then they’d have that amount of credit to use on Amazon for their purchases.

Or, if they have a debit card of their own you can attach that card for them to use, but still have the ability to approve their purchases. Then if you know they won’t have enough to cover that expense in their bank account at the end of the month you can talk to them again about financial responsibility….and that they need to save up.

What did my daughter buy on her own after saving her money from her first job…..a camera and a ukulele!!

Did she know how to play this new instrument, no. Would I have bought it for her if she hadn’t done chores/had a job to earn the money for it, I’m not sure (she already has so many instruments). But…..it was HER money and I knew she had enough to pay for it at the end of the month so it was totally up to her.

The look on her face when it came in the mail was priceless….and she appreciates it 100x more since she earned the money to pay for it all on her own (and takes care of it better too I think).

Teaching lessons on budgeting for teens is so important and once it clicks they’ll appreciate you for it….a lifelong lesson for sure.